From October 2023, the invoice has been launched in Japan.

About the system

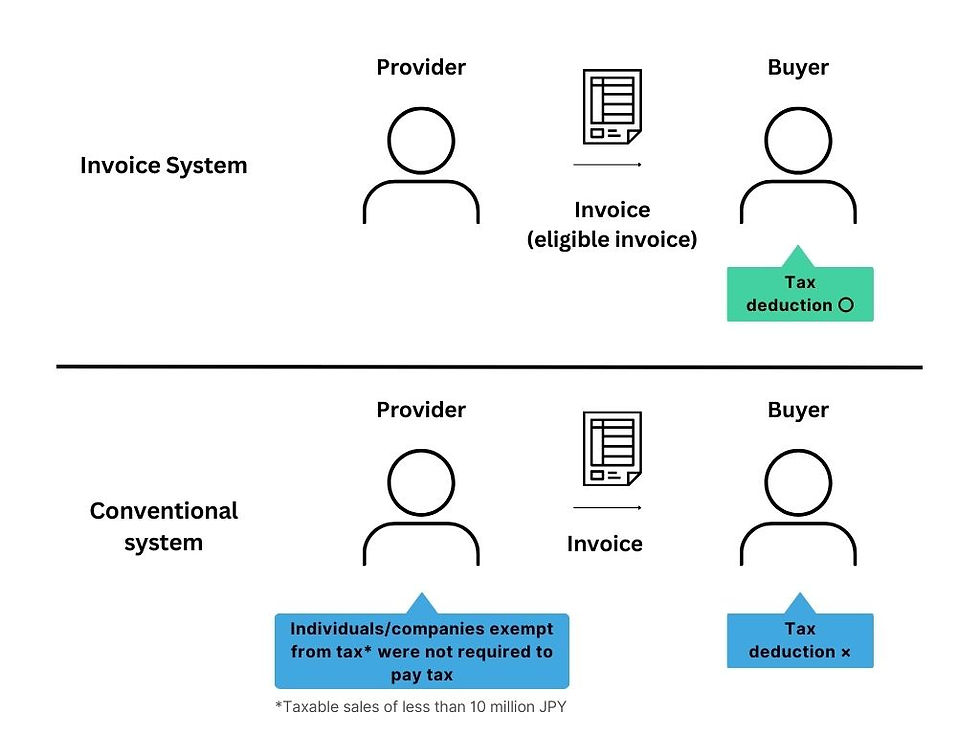

Due to the invoice system, buyers can no longer benefit from the purchase tax deduction without a qualified invoice issued by their suppliers.

To enable buyers to benefit from a tax deduction on purchases, suppliers must obtain an IRN (Invoice Registration Number) and pay VAT.

When it comes to declarations to the tax office, in addition to an income tax declaration, those who have obtained an IRN (invoice registration number) must also do VAT declaration. (Before this new invoice system, VAT declarations were not required for individuals/companies with taxable turnover of less than 10 million JPY).

Transitional measures for the invoice system

Transitional measures will enable this system to be introduced gradually.

If providers don’t obtain an IRN (invoice registration number), or if they plan to apply but have not yet done so, buyers can benefit from 8% instead of 10% VAT deduction (in full) for the first three years, and 5% for the following three years. Thereafter, after six years, no VAT deduction is possible if providers do not have an IRN (invoice registration number). In other words, providers do not need to pay VAT until they have obtained their registration numbers.

*Those who are in the process of applying are treated as VAT-registered providers, since they have to obtain their IRN (invoice registration number).

Obtaining an IRN (Invoice Registration Number)

You can apply for an IRN (Invoice Registration Number) at the tax office or via e-Tax.

Please note: as this new invoice system starts in October, the tax office is currently receiving many requests for this number, so the procedure is very long if you apply at the counter. What's more, the application form is complex. If the application is incomplete or incorrectly filled in, it will be considered incomplete or unfavorable*.

*Unfavorable situation = errors or omissions in the information may lead to the application of incorrect tax amounts in relation to the actual situation.

Services of Tominaga Tax & Accounting related to the invoice system

Application to obtain an IRN (Invoice Registration Number)

VAT declaration

Income tax return

Please do not hesitate to contact us for further information.

Comments